A surety agreement is another name for a surety bond providing individuals, companies, communities, and states with protection. There is a wide range of surety agreements.

Types Of Surety Agreements

A surety agreement can be used in court with either a plaintiff surety bond or defendant surety bond. These bonds cover actions taken by either party to protect the other against harm from an unlawful action.

A surety agreement can be used in court with either a plaintiff surety bond or defendant surety bond. These bonds cover actions taken by either party to protect the other against harm from an unlawful action.

Businesses may be required to secure a surety agreement before operating within in a state. These are referred to as permit and license bonds. An example is the California requirement of a seller of travel bond in order to offer services as a travel agent.

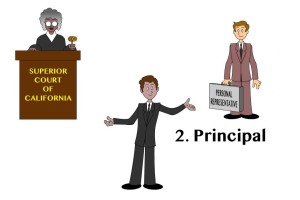

The final type of surety agreement is probate and fiduciary. Again this is a type of surety agreement covering actions that may impact innocent parties. An administrator bond represents this function since it covers all involved parties against the mishandling of an estate.

Why States Trust A Surety Agreement

States turn to surety agreements to protect residents and consumers. Requiring a business to obtain a bond helps keep businesses in compliance. It also holds them more accountable for when things go sour.

Right now in West Virginia and Wyoming state leaders are working to resolve the bankruptcy of one of America’s largest coal companies, Alpha Natural Resources. Since the company used self-bonds instead of secure surety bonds there is now $655 million in unsecured reclamations.

West Virginia is working to move the company from self-bonds to a surety bond. Wyoming isn’t making the same kind of push. Meaning any reclamations and clean up projects have to be funded a different way.

Speak With A Surety Expert

A surety bond expert at Jurisco will take the time to answer any questions about different agreements. They can also explain surety bond rates and how they are calculated.

Jurisco serves all 50 states with a firm understanding of individual state requirements. Contact Jurisco today to discuss the necessity of a surety agreement.